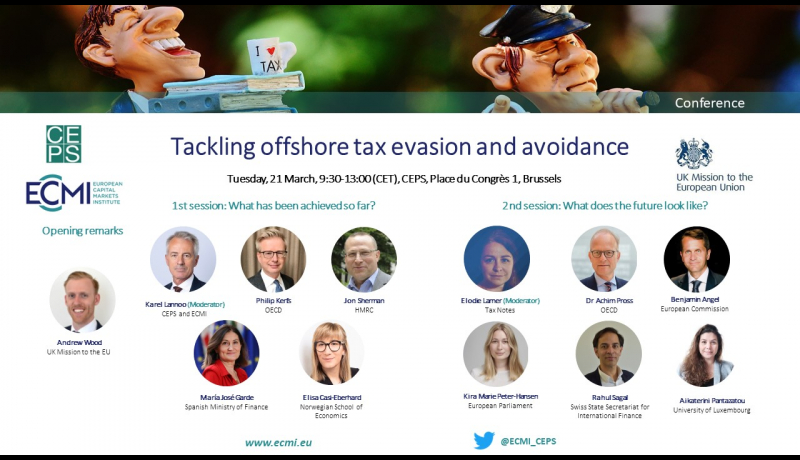

Tackling offshore tax evasion and avoidance

Over the past decade, the Organisation for Economic Cooperation and Development (OECD) has led the development of pivotal tax transparency agreements in an effort to put an end to bank secrecy and tackle offshore tax evasion and avoidance.

One of them, the Common Reporting Standard (CRS), agreed in 2014, revolutionised tax transparency by requiring financial institutions to report information on taxpayers’ offshore income and financial assets, which jurisdictions across the world then automatically exchange to help identify non-compliance. The digitalisation of the economy and the rapid development of crypto and other intangible assets resulted in the OECD revising the CRS and approving a new Crypto Asset Reporting Framework in August 2022.

The EU is also increasingly interested in this area. Over the last 10 years, there have been efforts to strengthen the cooperation among Member States through the Directive on Administrative Cooperation (DAC), as well as proposals to tackle the misuse of shell companies for tax purposes and the role of tax intermediaries in facilitating tax abuse.

More broadly, in the anti-money laundering and illicit finance space, countries globally have been moving towards the use of beneficial ownership registers as a key transparency tool to combat economic crime. This has already positively benefitted the tax transparency system but there are still unresolved questions about how such tools can be made truly global and bespoke to tax to combat offshore non-compliance.

Join this half-day conference organised by CEPS and the UK Mission to the EU to discuss the effectiveness of existing transparency frameworks in tackling offshore tax evasion and tax avoidance, and the future holds in terms of challenges to overcome and opportunities to exploit.

9:00 – 09:30 Registration and welcome

9:30 – 9:45 Introductory remarks by Andrew Wood, Economic Counsellor, UK Mission to the European Union

9:45 – 11:00 First session: What has been achieved so far?

This session will focus on the current state of play on international exchange and cooperation in the battle against tax evasion. It will also reflect on the collective efforts and the efficacy of existing agreements, and in particular the CRS, as well as on the political, legal and economic trends that have emerged.

Speakers

- Philip Kerfs, Head, International Cooperation Unit, Centre for Tax Policy and Administration, OECD

- María José Garde, Director General of Taxation, Spanish Ministry of Finance

- Jon Sherman, Director, Business, Assets and International, HMRC

- Elisa Casi-Eberhard, Professor of Economics, Norwegian School of Economics

Moderated by Karel Lannoo, CEO, CEPS and General Manger, ECMI

11:00 – 11:30 Coffee break

11:30 – 12:45 Second session: What does the future look like?

This session will discuss the future of the transparency project and linked areas, such as the increasing global proliferation of Beneficial Ownership registers as a key transparency tool. It will explore emerging risks and new fields for future frameworks.

Speakers

- Dr. Achim Pross, Deputy Director, Centre for Tax Policy and Administration, OECD

- Benjamin Angel, Director, DG TAXUD, European Commission

- Kira Marie Peter-Hansen, Vice-Chair, Subcommittee on Tax Matters, Greens/EFA, MEP

- Dr. Rahul Sahgal, Deputy Head, Tax Department, Swiss State Secretariat for International Finance

- Aikaterini Pantazatou, Professor of Tax Law, University of Luxembourg

Moderated by Elodie Lamer, Journalist, Tax Notes

12:45 – 13:00 Closing remarks by Karel Lannoo, CEO, CEPS and General Manger, ECMI

13:00 Lunch