Asset Allocation in a Low Interest Rate Environment: Where do we stand?

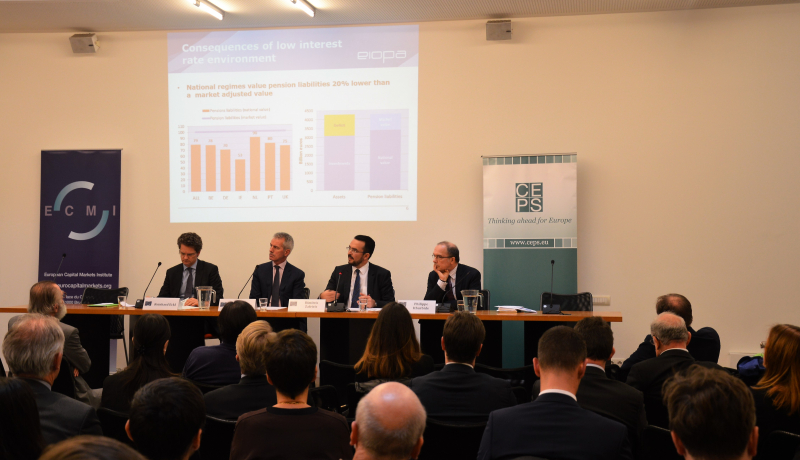

From a historical perspective, interest rates have been on a downward trend over the past four decades. In Europe, the financial and sovereign debt crises and the ensuing weak macroeconomic environment – persistent output gap, low growth and excessively low inflation – together with the expansionary monetary policy responses, in particular QE, have contributed to a further decline in interest rates. One of the key concerns is the extent to which a lasting low interest rate environment has the potential to undermine the ability of insurance undertakings and pension funds to fulfil their long-term financial promises to policy holders and beneficiaries. The consequences are likely to be widely varied across companies, largely depending on their business models, balance sheet structures and risk management strategies. Some of these institutional investors are also amongst the main sellers, i.e. the main counterparties, in the asset purchase programme implemented by the ECB.

- Have the insurance undertakings and pension funds significantly changed the composition/risk profile of their investment portfolios (fixed income, equity, and other investments) in the past five years?

- What type of asset/liability-driven strategies will be employed by insurance undertakings and pension funds in order to deal with the challenges posed by a prolonged period of low interest rates?

- Is there any evidence of a negative impact on the profitability and solvency of insurance undertakings and pension funds as a result of the unusual operating conditions?

- What kinds of responses can regulators and supervisory authorities take in the future with respect to the activities of insurance undertakings and pension funds? Is there a need for further action at EU level?

Speakers

- Dimitris Zafeiris, Head of Financial Stability, EIOPA

- Reinhard Eckl, Associate Director, Deputy Head of Regulatory Strategy, Allianz SE

- Philippe Ithurbide, Head of Global Research, Strategy and Analysis, Amundi

Moderated by Karel Lannoo, CEO, CEPS and General Manager, ECMI

A brief summary of the discussions is available HERE.

This ECMI event will be organised in the context of the Invest Week, in cooperation with PensionsEurope.