Developing the FinTech Ecosystem: the challenges of regulation, innovation and digitalisation

Between 2011 and 2015, global investment in FinTech increased eightfold. Resulting from the use of enabling digital technologies, new products and processes are being developed by “traditional” providers and by ever-rising numbers of FinTech startups. While policy-makers are gradually creating the necessary conditions to strengthen this digital transformation of financial services, numerous policy issues and unanswered questions remain. Against that background, CEPS, ECRI and ECMI are jointly organising their Annual Conference on “Developing the FinTech ecosystem: the challenges of regulation, innovation and digitalisation”.

Given the significant impact of digitalisation on all types of products and consumers, the objective of this conference is to provide a platform for an exchange of good practices across the various supervisors and providers of financial services, hereby contributing to greater regulatory consistency across the different segments of financial services. As such, the scope is relatively wide and intends to include retail financial services (credit, savings and payments), as well as investments and insurance. The programme will feature key stakeholders in the financial services sector and high-level speakers from the European institutions, national authorities, the financial industry, FinTech startups and academia.

This conference will first explore how and to which extent big data can benefit customers and providers alike. Innovation will also be debated with respect to payment systems, especially by assessing the winners and losers of the vast regulatory package for payments that is gradually implemented. Finally, each year, one specific market and type of technology will be singled out for in-depth coverage. This year’s conference will focus on blockchain and its impact on securities value chain.

Agenda

08:45 Registration

09:15 Opening remarks

09:20 Opening keynote address by Pēteris Zilgalvis, Head of Startups and Innovation, DG CONNECT, European Commission

09:50 Session I - Big data, innovation and regulation - getting the balance right

In recent years, the big data has been gradually disrupting the sector of financial services as a result of its core characteristics: high volume, high velocity and high variety (social media data, data produced by the Internet of Things, data contained in emails, etc). Helped by the strengthening of enabling technologies such as machine learning, the use of this big data can benefit both customers and providers, especially by further personalising services (notably via robot-adviser) or improving security in processes. Nevertheless, the intensity of the impact of this new data will likely differ across the phases of the products, as well as across the types of customers and products. In addition, such a wide phenomenon can trigger specific risks for financial services in relation to data privacy, the quality of the used data, the exclusion of the “most risky” profiles, the ethics of algorithms, etc. This panel will offer the possibility to assess the opportunities and risks related to the use of big data for financial services, and to discuss how and to which extent the implementation of rules such as the recently enacted General Data Protection Regulation (GDPR) can better address these risks.

Speaker: Christopher Docksey, Director, European Data Protection Supervisor

Panellists:

- Karl Gray, Global Head of Casualty, Motor & Personal Lines, Zurich Insurance

- Greg Van Elsen, Senior Financial Services Officer, BEUC

- Adrien Vesteghem, Head of Bigger Data, BNP Paribas Personal Finance

Moderator: Sylvain Bouyon, Research Fellow, ECRI/CEPS

11:20 Coffee break

11:40 Session II - A new era for payment: myths and realities

On the back of the fast growth in e-commerce, dramatic changes in the expectations of customers and gradual maturing of enabling technologies, the development of innovative payment solutions has been so far the main driver behind the wide digital transformation observed in financial services. Against that background, it is no surprise that the sector has been the object of a large range of new European rules: PSD2, MIF, SEPA, etc. The objective of these rules is twofold: on one hand addressing the new risks triggered by digitalisation; on the other hand, contributing to shape the payment landscape of tomorrow. The purpose of this panel will be to assess how and to which extent the different market actors are being impacted by digitalisation and the regulatory package for payments: banks, customers, FinTech startups, clearing platforms, etc.

Panellists

- Martin Schmalzried, Senior Policy and Advocacy Officer, COFACE

- Ralf Jacob, Head of Retail Financial Services and Payments, DG FISMA, European Commission

- Paul Thomalla, Global Head of Corporate Relations and Development, ACI Worldwide

- James Butland, European Banking Lead, TransferWise

Moderator: Willem Pieter De Groen, Research Fellow, CEPS

13:00 Lunch break

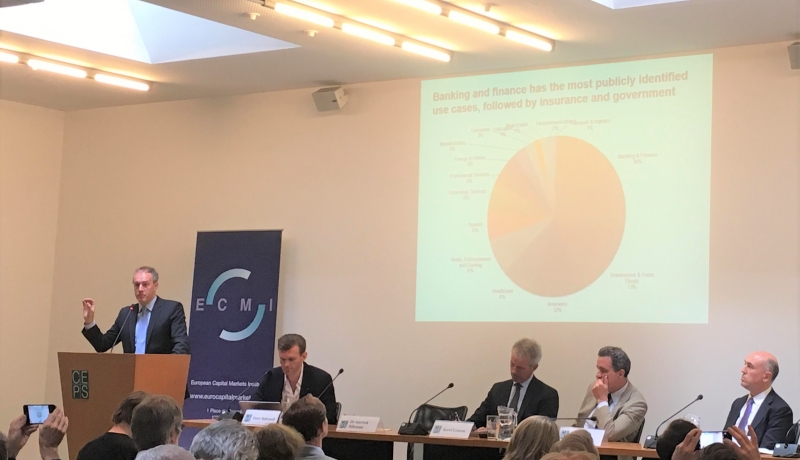

14:00 Session III - Special focus: blockchain application and its impact on securities value chain

Bitcoin’s underlying distributed ledger technology (DLT) is still at an early stage; there is no DLT system operating at a large scale in financial markets yet. Multiple DLT solutions covering various segments in the securities transactions value chain will continue to emerge in the coming years and be subjected to proof-of-concept testing. The financial services industry needs to address the already long-standing operational and cost inefficiencies and enable further simplification, standardisation and transparency. For example, clearing, settlement and other post-trade processes currently cost the global financial industry well in excess of €50 billion per year. Collateral management, record of ownership and securities servicing are also other areas where the technology is most likely to bring useful changes. There are a number of challenges (adopting common standards, sharing the same reference data, using the same protocols) to be addressed, in addition to the technology itself (robustness, privacy, governance, interoperability with existing networks) and the regulatory constraints.

Speaker: Dr Garrick Hileman, Senior Research Associate, Cambridge Centre for Alternative Finance

Panellists

- Patrick Armstrong, Senior Officer, Financial Innovation, ESMA

- Peter Bidewell, Chief Marketing Officer, Applied Blockchain

- Greg Allen, Chief Technology Officer, LSEG

Moderator: Karel Lannoo, CEO, CEPS

15:25 Concluding remarks

15:30 End of the conference

Registration

- Registration is free of charge for CEPS/ECMI/ECRI members, EU/national officials, full-time academics, PhD students (subject to available seats), NGOs (not representing industry sectors or a commercial interest) and press.

- Other participants may be admitted for €250 (VAT included, payable in advance or at the registration desk).